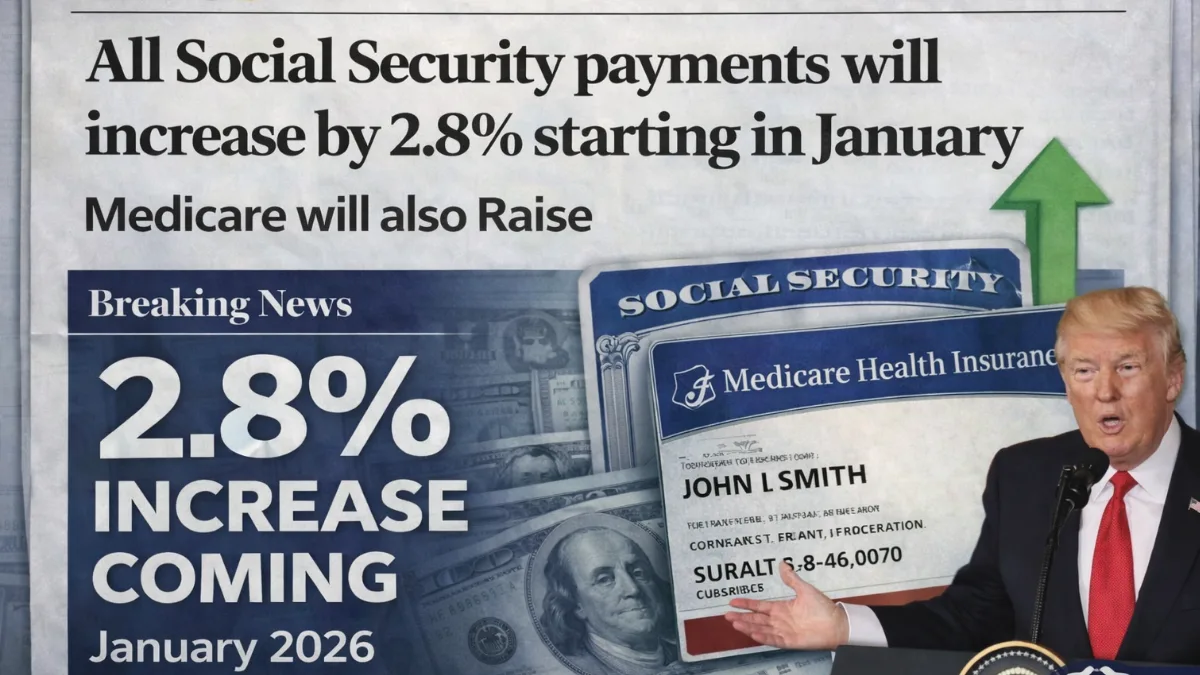

Social Security Benefits Just Got Bigger: For more than 70 million Americans who rely on Social Security or Supplemental Security Income, January 2026 brings meaningful financial relief. Monthly benefit checks have officially increased due to the annual Cost-of-Living Adjustment, commonly known as COLA. This adjustment is automatic and applies to retirees, people with disabilities, and survivors who depend on these payments as a primary source of income.

With prices for groceries, utilities, healthcare, and everyday essentials remaining high, even a modest increase matters. For individuals living on fixed incomes, the COLA helps ensure that benefits do not lose value over time. It acts as a financial cushion that allows households to keep up with rising costs without falling behind.

What the Cost-of-Living Adjustment Really Means

The COLA is not a bonus or a special payment approved by lawmakers each year. It is a permanent feature of the Social Security system written into law. The adjustment exists to protect beneficiaries from inflation, which gradually reduces purchasing power when prices rise faster than income.

Each year, the Social Security Administration reviews inflation data to determine whether benefits need to increase. When inflation is present, the COLA ensures that Social Security and SSI payments rise to match it. This process keeps benefits aligned with real-world living costs.

How the COLA Is Calculated

The COLA is calculated using a government inflation measure called the Consumer Price Index for Urban Wage Earners and Clerical Workers, known as CPI-W. The administration compares price data from the third quarter of one year to the same period in the following year. If prices increase, benefits are adjusted upward.

This method focuses on everyday expenses such as food, housing, transportation, and medical care. Because the calculation follows a fixed formula, the COLA is not influenced by political decisions or budget negotiations. It rises only when inflation data shows that costs have gone up.

How Your Monthly Benefit Changes

Calculating your new Social Security payment after the COLA is fairly simple. The adjustment is applied as a percentage increase to your current gross monthly benefit. The higher your existing benefit, the larger the dollar increase will be, even though the percentage is the same for everyone.

The updated amount appears automatically in your January 2026 payment. For Social Security recipients, the increase technically applies to December benefits that are paid in January. For SSI recipients, the increased amount is reflected directly in the January payment, which usually arrives at the start of the month.

Why This Increase Matters for Daily Life

For many households, Social Security is not supplemental income but the main source of monthly support. Rent, electricity bills, prescription medications, and food costs continue to rise, leaving little room for flexibility. The COLA helps reduce the gap between fixed income and growing expenses.

While the increase may not cover every added cost, it can prevent financial strain from worsening. Even small monthly changes can help beneficiaries avoid using credit cards, delaying bill payments, or cutting back on essential needs.

Impact Beyond Retirement Benefits

The COLA does more than raise retirement checks. It also increases Supplemental Security Income payments, including the maximum federal benefit amounts for individuals and couples. This ensures that the lowest-income Americans are not left behind as prices rise.

The adjustment also affects Medicare Part B premiums. Although premiums often increase each year, a rule known as the hold harmless provision protects most beneficiaries. This rule prevents Medicare premium increases from reducing the net amount of a Social Security check when the COLA is smaller than the premium increase.

Working While Receiving Benefits

For people who receive Social Security but continue working before reaching full retirement age, the COLA has another effect. Earnings limits are adjusted upward in line with inflation. This means beneficiaries can earn slightly more income without triggering a reduction in benefits.

This change is especially helpful for those who rely on part-time work to supplement their monthly checks. Higher limits provide flexibility and allow individuals to stay active in the workforce without financial penalties.

Planning Wisely With the Increase

Although the COLA increase is automatic, using it wisely can improve long-term financial stability. Many beneficiaries choose to first apply the additional funds toward essential expenses that have increased over the past year. This helps stabilize monthly budgets.

Others use the extra income to reduce high-interest debt or build small emergency savings. Even modest savings can make a difference when unexpected expenses arise, such as medical costs or home repairs.

How to Confirm Your New Payment Amount

No application or paperwork is required to receive the COLA increase. It is applied automatically to eligible benefits. Beneficiaries can verify their updated payment amount by logging into their online Social Security account, where official notices and payment details are available.

Checking your updated information helps avoid confusion and ensures that records are accurate. It also provides clarity when planning monthly expenses for the year ahead.

Looking Ahead With Greater Security

The annual COLA highlights the long-term purpose of Social Security. It is designed not only to provide income but to protect that income from inflation over time. This feature has become increasingly important as living costs rise faster than many other sources of retirement income.

While no single increase solves every financial challenge, the January 2026 adjustment reinforces the reliability of Social Security. It remains a stable, inflation-protected foundation that millions of Americans depend on for economic security.

Disclaimer

This article is for informational purposes only and does not constitute financial, legal, or retirement advice. Benefit amounts, COLA percentages, and program rules may change based on official government updates. Readers should consult the Social Security Administration or a qualified financial professional for guidance specific to their individual situation.